- BLOG

Retail Distribution: Strategy & Best Practices

Published: December 9, 2025

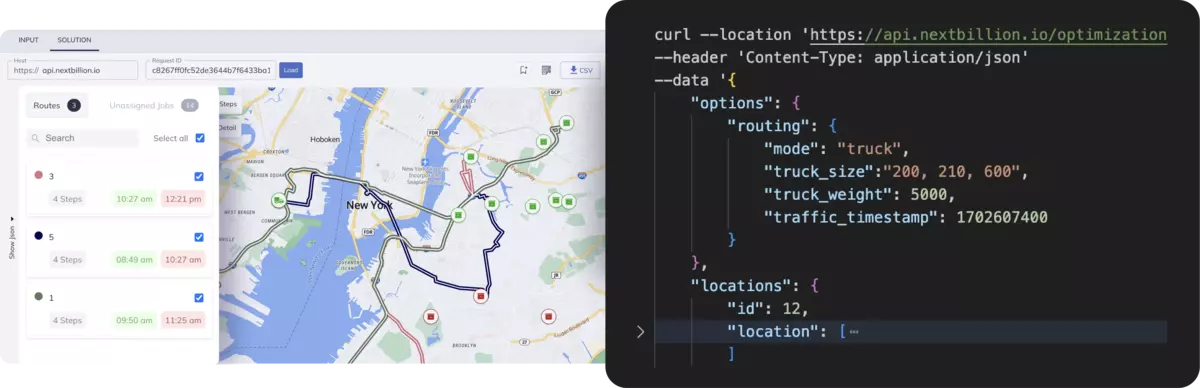

Route Optimization API

Optimize routing, task allocation and dispatch

Distance Matrix API

Calculate accurate ETAs, distances and directions

Directions API

Compute routes between two locations

Driver Assignment API

Assign the best driver for every order

Routing & Dispatch App

Plan optimized routes with 50+ Constraints

Product Demos

See NextBillion.ai APIs & SDKs In action

AI Route Optimization

Learns from Your Fleet’s Past Performance

Platform Overview

Learn about how Nextbillion.ai's platform is designed

Road Editor App

Private Routing Preferences For Custom Routing

On-Premise Deployments

Take Full Control of Your Maps and Routing

Table of Contents

Have you ever wondered why some brands always seem stocked and ready, while others constantly battle empty shelves and delayed deliveries? McKinsey notes that nine in ten companies still suffer supply disruptions because their visibility beyond tier-one suppliers remains limited, a hidden weakness that quietly undermines retail distribution. When products can’t move smoothly from manufacturers to store shelves, even the strongest brands lose sales, customer loyalty, and market momentum. This is why choosing the right retail distribution strategy has become a defining advantage for businesses aiming to scale efficiently and consistently.

Want the full picture? Continue reading the blog to explore how strategic distribution can transform your retail performance.

Did you know!

Retail distribution is much more than merely the transportation of goods between Point A and Point B, it is the mechanism that links the production process to the market demand so that the product travels in a well-organized manner between manufacturers and the ultimate customer. It entails the use of a well-organized chain of wholesalers, distributors, retailers, and direct-to-consumer outlets that collaborate to ensure that the right products are in the right place at the right time when customers want them.

Retail distribution is, at its most fundamental, a combination of strategy, infrastructure, and real-time decision-making that encompasses channel selection and inventory planning, network design, retail partnerships, last-mile delivery, and fulfilment of digital commerce. Regardless of whether a brand is sold by big-box stores, niche specialty stores, owned stores, or eCommerce platforms, the quality of a distribution system is directly related to the availability, customer experience, and revenue performance.

Each item on a shelf or doorstep has gone through a highly designed series of processes, an end-to-end process that has been engineered to find a balance between cost, speed, and service quality. The knowledge about this flow assists in the revelation of the importance of distribution excellence to contemporary retail. Here is how retail distribution works:

Production: The process starts at the manufacturing plant where products are produced, checked, and packed. This step is concerned with quality consistency, whereby each unit is of brand standards and can withstand transportation, storage, and display without being damaged.

Warehousing: When manufactured goods are transferred into warehousing or central fulfilment centres, which are strategic nodes that cushion supply against erratic demand. Good warehousing ensures stock-outs are avoided, there is less overstocking, and it facilitates dynamic replenishment within the retail channels.

Transportation: Products move through a logistics system out of the warehouse into the retailers, distributors, or to the consumers themselves. This move involves optimisation of routes, trusted carriers, and transport modes that are cost effective to ensure speed, minimise risks of damages, and sustain unit economics.

Retailing: The last point is where the product is encountered by the customer, either in a physical store or an online store. Retailers do not just display and sell goods but also create the brand experience. It affects the purchasing decisions based on merchandising, availability, and the quality of service.

Here are the most prominent types of retail distribution strategies that brands use to shape availability, reach, and customer experience:

Direct distribution can be described as a paradigm in which a brand sells its product directly to the consumer, without the help of intermediaries. This can be through physical outlets, an official website, an application, social commerce platforms, or listing on a marketplace operated by the brand.

Direct distribution is preferred by brands since it provides them with full control over pricing, packaging, brand narration, and customer experience. This close relationship allows real time feedback loops, stronger brand loyalty, and increases in margins as no retailer makes a cut.

Nevertheless, complete control implies complete responsibility: the brand has to develop powerful logistics, warehousing, last-mile delivery, customer service, and marketing systems. In the absence of these systems, there is a poor customer experience.

Example: Warby Parker had constructed its whole enterprise around direct distribution, or selling eyewear via its own web and retail outlets. It managed to control all touchpoints, establishing new standards of price transparency, customer experience, and home try-ons.

Indirect distribution entails dealing with distributors, wholesalers, and retailers who undertake different aspects of the go-to-market process. Rather than controlling all of the processes, brands use existing retail platforms that offer reach, speed, and market knowledge.

This is a good strategy when expanding into new market areas, with different customer markets, or expanding rapidly. Distributors also make the processes easier since they can share the burden of responsibilities like storage, transportation, merchandising, and retail placement. The tradeoff is that the brand loses some control over pricing, presentation, and in-store experience, and margins decline as middlemen need to be paid.

Example: The Nestle Company employs indirect distribution to access millions of retail stores across the globe. Nestle products reach scale and availability in remote markets through distributors that would not be possible in direct channels only.

Exclusive distribution is common when the product is a prestige or specialised good where a brand deliberately limits distribution to ensure exclusivity and safeguard its premium positioning. The sale of products is done by a single authorised retailer or very few partners within a territory.

The strategy enables the brand to be very specific in controlling the customer experience, brand image, pricing, and service standards. It also increases margins through decreasing price competition and increasing perceived value. Exclusive distribution is most effective when the customers are ready to search the product because of its elite status, heritage, or exclusiveness.

Example: Rolls-Royce approves few showrooms all over the world. Every place is highly designed in terms of craftsmanship, heritage, and ultra-luxury service standards of the brand.

Selective distribution is a strategy of collaborating with a specific group of retailers, which are selected according to specific criteria including location, quality of service, expertise in specific category, and attractiveness to the target audience of the brand. This strategy is a compromise between exclusivity and market coverage.

It is particularly useful with products that need to be sold more knowledgeably, offer specialised after sales service, or have a premium positioning that cannot be watered down by mass placements. Brands can work in a close partnership with retail partners in the areas of merchandising, training, and co-marketing to define the customer experience.

Example: Dyson is sold via a selective group of retailers of electronics and home appliances like Best Buy and its own experience stores. This guarantees that the customers are exposed to trained personnel, product demonstrations, and appropriate merchandising.

Intensive distribution aims at maximum exposure of the product to the retail stores and channels as many as possible. It is the choice of strategy in the case of daily consumer products that are dependent on convenience, impulse buying, and frequent purchases. This model is availability-driven. The product should be available in any place to the customers such as supermarkets, convenience stores, pharmacies, vending machines, or online markets. Due to the ease with which consumers change brands in case they cannot find their favorite, it requires a wide coverage.

Example: Lay, under PepsiCo, deploys intensive distribution to be found in the grocery aisles, corner stores, airports, gas stations, stadiums, and online platforms. This makes the brand an omnipresent and top of mind brand.

Strategy | What It Means | Best For | Key Advantages | Limitations |

Direct Distribution | Brand sells directly to customers through owned channels. | Premium, high-margin, or digitally native brands. | Full control, higher margins, direct customer relationship. | Requires strong logistics and customer service capabilities. |

Indirect Distribution | Distributors and retailers manage parts of the go-to-market process. | Brands seeking scale, regional expansion, or broad reach. | Faster expansion, operational relief, access to retail networks. | Less control over pricing, experience, and margins. |

Exclusive Distribution | Product sold through one authorised retailer or very limited partners. | Luxury or specialised goods. | High brand control, prestige, strong margins, limited competition. | Very limited availability; customers must seek it out. |

Selective Distribution | Carefully chosen retailers based on criteria like location and service capability. | Premium, technical, or service-heavy products. | Better customer experience, skilled selling, controlled brand image. | Reduced reach compared to mass retail. |

Intensive Distribution | Products placed in as many outlets and channels as possible. | FMCG, convenience goods, high-frequency purchases. | High visibility, maximum availability, impulse-driven sales. | Lower brand control; must manage wide network. |

Even if you already have a retail distribution strategy in place, that doesn’t guarantee you are truly getting the most out of it. If your retail distribution efforts are yielding more headaches than profits, then it’s time to seek ways to better your strategy.

Practical steps on how to optimise your retail distribution strategy:

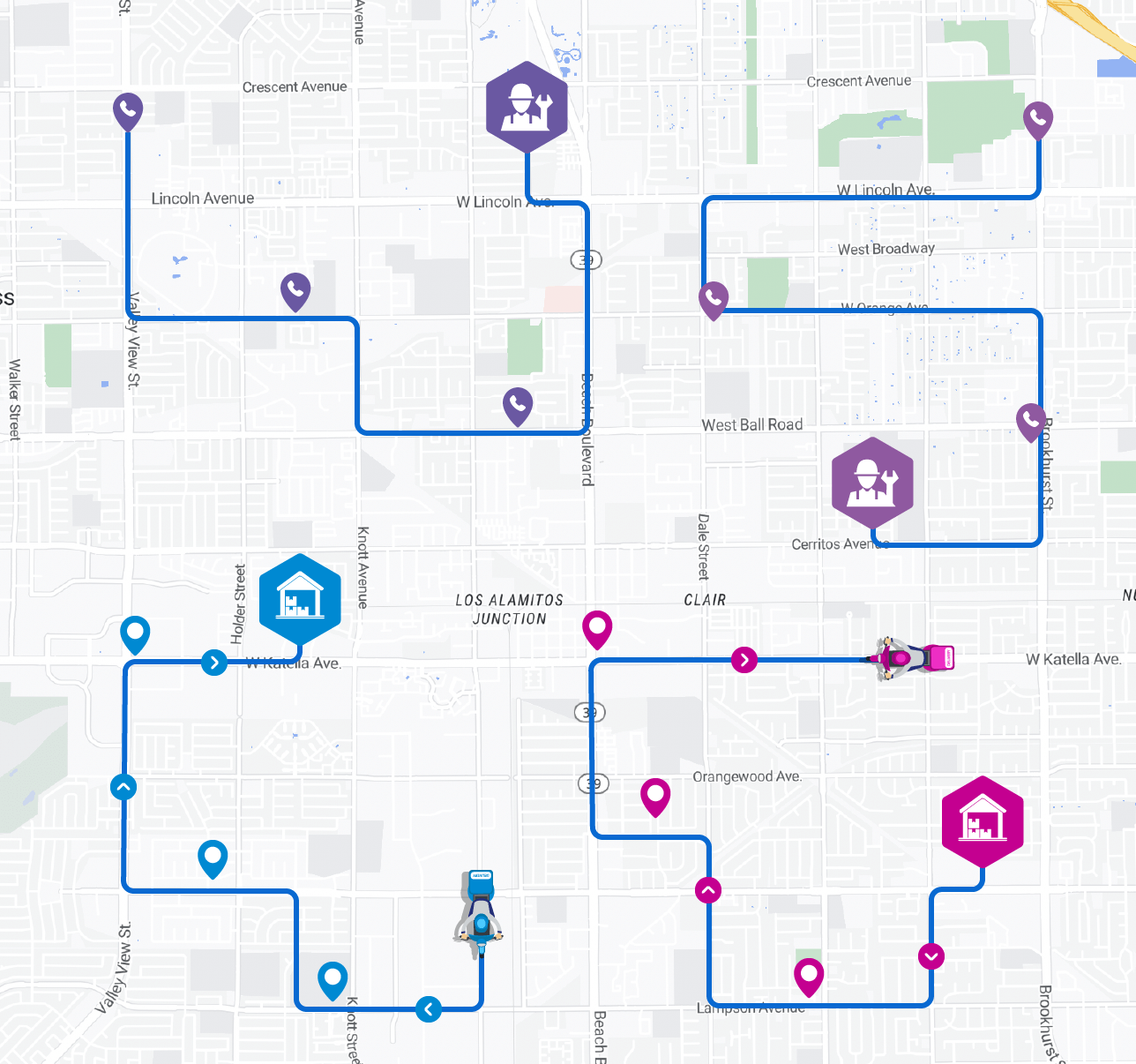

Market penetration depends on good outlet coverage of a brand. By having field teams go to the correct stores with the right frequency, there is enhanced availability, predictable orders, and visibility throughout the retail environment. Smart routing balances the daily field operation and the commercial priorities, and there is no high-value outlet that is missed.

How to implement?

What to avoid?

One of the best indicators of distribution health is a high fill rate. Retailers make more sales, customers develop trust, and demand levels rise when the products are always present on shelves. Forecasting based on data turns the distribution from a reactive replenishment into a proactive plan.

How to implement?

What to avoid?

Proper field performance produces enhanced merchandising, improved servicing, and trustworthy retailer relations. Real visit verification ensures reps actually enter outlets, improving accountability and maintaining execution integrity across the distribution chain.

How to implement?

What to avoid?

Focus on the right product and a right outlet. Smart assortment planning matches product mix to outlet type, shopper profile, and sales velocity. This makes shelves productive, minimizes the risk of expiry, and increases overall returns on shelf space.

How to implement?

What to avoid?

Powerful distributors increase the presence of a brand and make sure that the market is covered. An ecosystem of distributors that is managed effectively leads to improved fulfilment, healthier inventories, and regular execution of retail. Management based on partnership results in long-term returns that are sustainable.

How to implement?

What to avoid?

Digital order taking streamlines the retail engagement by removing manual errors, shortening fulfilment speed, and enhancing SKU-level visibility. It releases reps of paperwork and allows stores to order exactly what they require.

How to implement?

What to avoid?

The retailers vary in their contribution to sales and brand presence. Their prioritisation, considering potential and performance, will be more efficient in using field force time, trade spend, and visibility investments.

How to implement?

What to avoid?

Returns are inevitable, especially in omnichannel retail. A structured reverse logistics system reduces waste, accelerates recovery, and strengthens customer confidence. It also provides valuable insight into product quality issues.

How to implement?

What to avoid?

Operational KPIs indicate the health of the distribution network, whereas sales reflect the results. Monitoring these indicators at an early stage allows timely measures and more effective actions on the ground.

How to implement?

What to avoid?

Distribution is vital in influencing the perceptions of customers on the brand at the touchpoints. Quick delivery, convenient returns, and precise fulfilment foster long term loyalty and brand differentiation in competitive markets.

How to implement?

What to avoid?

The retail distribution is changing in the context of increased transportation expenses, unpredictable last-mile issues, disjointed networks, and customers that are now demanding speed, accuracy, and visibility. A distribution channel which used to be a mere channel of transporting goods has been transformed into a strategic differentiator. NextBillion AI enhances this benefit by hyper-local, AI-based mapping, routing, and verification technology, transforming distribution into a scalable, intelligent asset instead of a cost-heavy operation.

NextBillion.ai improves the spatial and logistical infrastructure of retail supply chains with a robust collection of APIs and SDKs. These tools are meant to enhance the efficiency of routing as well as introduce data-driven accuracy to the movement, timing, and field execution in all aspects of the distribution chain.

Here are the top advantages that NextBillion AI brings to modern retail distribution:

Intelligent routing makes direct store deliveries even more cost-effective. NextBillion AI saves on unnecessary mileage, fuel, and wear and tear of the vehicle. This optimisation reduces the distribution expenses of manufacturers and retailers.

The inventory is delivered to stores in a shorter time as the transit routes are shorter, smarter, and re-optimised dynamically. Merchants gain access to increased shelf space, faster turnover, and less stockout, particularly in those categories that are sensitive to freshness like dairy, bakery products, and fresh produce.

Effective inventory flow guarantees that shoppers experience fewer cases of out-of-stock products, and when they get them, they are in a better condition. This increases brand loyalty and leads to repeat buying. Having shelves that are well stocked and deliveries that are on time makes the entire shopping experience more reliable and satisfying.

Retail distribution has transformed into a strategic pillar which influences customer satisfaction, efficiency in operation, and long-term competitiveness. Distribution-oriented brands will be ahead in the markets where physical stores, omnichannel purchase, and direct-to-consumer strategies need to be coordinated.

A robust, adaptable, and intelligently optimised distribution system enables companies to penetrate new markets quicker, reduce the delivery time frames, and have a robust brand name. When you make your next big retail move, you will not forget that a good product will generate demand, but a strong distribution strategy will turn that demand into revenue, loyalty, and growth.

Turn your distribution network into a competitive advantage. Get a demo of NextBillion.ai.

Bhavisha Bhatia is a Computer Science graduate with a passion for writing technical blogs that make complex technical concepts engaging and easy to understand. She is intrigued by the technological developments shaping the course of the world and the beautiful nature around us.