- BLOG

GPS Mileage Tracking Apps for Delivery Drivers in 2025

Published: August 21, 2025

Route Optimization API

Optimize routing, task allocation and dispatch

Distance Matrix API

Calculate accurate ETAs, distances and directions

Directions API

Compute routes between two locations

Driver Assignment API

Assign the best driver for every order

Routing & Dispatch App

Plan optimized routes with 50+ Constraints

Trucking

Get regulation-compliant truck routes

Fleet Management

Solve fleet tracking, routing and navigation

Middle Mile Delivery

Optimized supply chain routes

Construction

Routes for Construction Material Delivery

Oil & Gas

Safe & Compliant Routing

Food & Beverage

Plan deliveries of refrigerated goods with regular shipments

Table of Contents

In 2025, the landscape of delivery logistics is defined by the widespread adoption of GPS mileage tracking apps. These applications have become indispensable for delivery drivers, enabling precise route monitoring, real-time location tracking, automated mileage logging, and advanced data analytics. As e-commerce and on-demand delivery services continue to surge, the demand for accurate, efficient, and user-friendly mileage tracking solutions has never been greater.

Integrated with broader fleet management or expense tracking systems, GPS mileage tracking apps streamline operations for both drivers and businesses.

Some of the main features include:

NextBillion.ai is a platform offering APIs and SDKs that enable organizations to build their own advanced, customizable mileage tracking, route planning, fleet management, and reimbursement solutions. Businesses, logistics companies, and software providers can embed NextBillion.ai’s suite of location, routing, and tracking APIs into their own products or operations for comprehensive, automated mileage tracking and reporting.

1. Live Tracking API and SDK

For information on how Live Tracking API works, refer here.

2. Route Planning & Optimization

For information on how Route Optimization API works, refer here.

3. APIs for Customization

4. Analytics and Reporting

✅ Highly customizable via API/SDK

✅ Handles enterprise routing/mileage at massive scale

✅ Accurate real-time and historical tracking

✅ Advanced constraint handling for logistics use cases

✅ Enterprise-grade privacy and compliance features

✅ Flexible asset- or usage-based pricing

❌ Requires developer resources for integration

❌ Not a plug-and-play app for individuals

❌ Pricing transparency typically available after demo/consultation

❌ Focused on business/fleet use, not targeted to freelancers/consumers

❌ Integration and onboarding require technical effort

Mileafy is a mileage tracking app designed to automate the process of recording and documenting business and personal driving mileage.

Here are some of Mileafy’s features:

✅ Starts and stops trip recording automatically using GPS and motion sensors. No need to remember to turn it on.

✅ Smartly categorizes trips as Business, Personal, or Custom based on your driving patterns.

✅ Lets you track mileage for multiple vehicles under one account.

❌ Not available on Android. Only supports iPhone and iPad users.

❌ The free version limits the number of automatic trips you can track per month (e.g., 30–50). You need a subscription for unlimited auto-tracking.

❌ Like many GPS-based apps, there’s a small chance of missed trips if the phone’s GPS is turned off or restricted by iOS settings.

The app is free to download with a limited free tier; additional features and unlimited automatic tracking are required in‑app purchases.

The available premium plans (shown as “Premium” and “Premium+”) include:

Premium: approximately $4.99 to $17.99 USD (several price points) and Premium+: approximately $49.99 to $89.99 USD

Hurdlr is a comprehensive mileage tracking app designed for self-employed professionals, freelancers, gig workers (such as Uber and Lyft drivers), and small business owners.

Here are some of Hurdlr’s features:

✅ Runs in the background without draining too much battery. Easily classifies trips as business or personal.

✅ Continuously calculates taxes owed, including self-employment tax. Helps avoid surprise tax bills.

✅ Designed for Uber, Lyft drivers, Airbnb hosts, freelancers, and small businesses. Tracks multiple income streams in one place.

❌ Not as full-featured as QuickBooks or Xero for larger businesses.vLacks inventory tracking and payroll.

❌ No automatic mileage or expense tracking in the free version. Tax calculations only available in Premium and Pro.

❌ Background activity restrictions on your phone may cause the GPS to miss trips. Additionally, some users have reported issues with duplicate or misclassified transactions.

Everlance is a type of mileage and expense software that helps companies reduce reimbursement costs, save time and deliver an attractive job benefit to mobile workers.

Here are some of Everlance’s features:

✅ The app is known for its intuitive interface, making it simple for users to navigate and operate without a steep learning curve.

✅ Easy Tracking: Automatic trip detection and logging allow users to track mileage with minimal manual input, reducing errors and saving time.

✅ Mileage Tracking: Everlance’s core feature is accurate, GPS-based mileage tracking, which is essential for maximizing tax deductions and reimbursements.

❌ Some users report occasional glitches or system errors that can disrupt tracking or data logging.

❌ Running the app in the background for GPS tracking can lead to increased battery consumption on mobile devices.

❌ There are instances where the app may not accurately detect or log locations, potentially affecting mileage records.

Free Trial is available.

Stride is a popular free mileage and expense tracking app designed primarily for self-employed individuals, freelancers, delivery drivers, gig workers, and small business owners.

Here are some of Stride’s features:

✅ Stride is completely free for mileage, income, and expense tracking with no hidden fees. The app has a simple, user-friendly design ideal for freelancers and gig workers.

✅ Automatically tracks mileage and expenses to maximize tax deductions. Provides real-time tax estimates and generates IRS-ready reports for smooth filing.

✅ Offers ACA-compliant health, dental, vision, and life insurance with personalized recommendations. Includes a marketplace with discounts on gas, car repairs, and other gig-related expenses.

❌ Lacks full accounting capabilities like double-entry bookkeeping, invoicing, or multi-currency support. Not suitable for larger businesses needing more complex financial tools.

❌ Stride is a marketplace, not an insurer, so coverage options and provider networks depend on location. Availability may vary by state, and some users report outdated network information.

❌ GPS tracking may miss trips if phone settings restrict background activity. Manual review is often needed for accuracy in expense categorization.

The App Is Completely Free. No cost to download or use the Stride app for mileage tracking, expense tracking, tax estimates, or access to discounts. You only pay for insurance if you choose and enroll in a plan through the app.

Zoho Expense serves as a versatile mileage tracking app focused on streamlining mileage reimbursement and expense management for businesses and employees.

Here are some of Zoho Expense’s features:

✅ Streamlines expense reporting with receipt scanning, automatic categorization, and corporate card integration. Reduces manual work and speeds up reimbursement processes.

✅ Allows businesses to set detailed expense policies, spending limits, and multi-level approval workflows. Helps enforce compliance and reduces policy violations with real-time alerts

✅ Offers a free plan for small teams and affordable pricing for growing businesses. Scales well for global organizations with multi-currency, multi-tax, and advanced reporting capabilities..

❌ Does not offer full-fledged accounting tools like payroll or inventory management. May require integration with Zoho Books or other software for complete financial management.

❌ Initial setup of policies, approvals, and integrations can be complex for first-time users. Some advanced features may require training for admins and employees.

❌ While functional, the mobile app lacks some advanced features available on the web version. Occasional syncing delays or minor glitches reported by users.

SherpaShare is a mileage tracking app purpose-built for rideshare and delivery drivers, particularly those working for Uber, Lyft, DoorDash, and similar platforms.

Here are some of SherpaShare’s features:

✅ Built directly into SharePoint and Azure, SharePA enables users to create complex automated workflows such as document approvals, task assignments, and policy enforcement with a drag-and-drop, no-code interface.

✅ Provides fully configurable dashboards to track workflow status and performance metrics. Includes templated notifications to ensure timely communication and task follow-ups across teams.

✅ Automates document lifecycle processes, enforces compliance policies, and provides full audit trails for transparency and governance. Helps organizations maintain structured document hierarchies and adhere to regulatory requirements.

❌ Designed specifically for SharePoint and Azure environments, which may limit its usefulness for organizations using other platforms or mixed systems.

❌ While it is no-code, configuring complex workflows and dashboards may still require SharePoint expertise during initial implementation.

❌ Pricing can be a concern for small businesses or teams with limited budgets, especially if they don’t fully utilize all advanced features.

MileIQ is a leading automatic mileage tracking app designed to simplify drive logging for tax deductions and reimbursements. Its core strength lies in its automatic, background GPS tracking, which records every drive without requiring manual start or stop actions.

Here are some of MileIQ’s features:

✅ Runs in the background and logs trips automatically without requiring manual start and stop.

✅ Classify trips as business or personal with a swipe and add custom notes or tags for detailed reporting.

✅ Generates IRS-compliant reports and offers team management tools like dashboards and approval workflows for businesses.

❌ Free version only tracks up to 40 drives per month, which may not be enough for active users.

❌ May miss trips or log incomplete data if the device loses connectivity or GPS signal.

❌ Recent subscription price hikes have made it less appealing to cost-sensitive users.

TripLog is a widely adopted mileage tracking app used by freelancers, gig workers, self-employed professionals, and businesses of all sizes to automate, document, and manage mileage and expense records for tax deductions or reimbursements.

Here are some of TripLog’s features:

✅ Combines mileage tracking, expense management, and time tracking in one app. Supports multiple tracking methods including automatic GPS and hardware devices for maximum accuracy

✅ Offers robust tools like admin dashboards, approval workflows, and policy enforcement, making it ideal for businesses of all sizes.

✅ Generates IRS-compliant and custom reports with multi-currency and global tax support for international users.

❌ The extensive feature set and configuration options can feel overwhelming at first, especially for solo users.

❌ Some users report missed trips or glitches with GPS tracking, though these are often tied to device settings or connectivity.

❌ While there is a free plan, advanced features and hardware add-ons like TripLog Drive or Beacon increase the overall cost.

Rydoo is a robust mileage tracking app integrated within its expense management platform, designed for businesses and employees who need fast, compliant, and user-friendly mileage reimbursement workflows.

Here are some of Rydoo’s features:

✅ Allows employees to quickly capture, submit, and track expenses in real time with an intuitive mobile app.

✅ Supports multi-level approvals, custom policy rules, Smart Audit, and global tax compliance, making it ideal for international businesses.

✅ Integrates with major ERP and accounting systems and scales easily for organizations of any size, from startups to large enterprises.

❌ Some advanced features like Smart Audit, API access, and corporate card integration are only available in higher-tier plans.

❌ Setting up complex policies, workflows, and integrations may require time and training for finance teams.

❌ Pricing may be less attractive for very small businesses or freelancers compared to simpler expense tools.

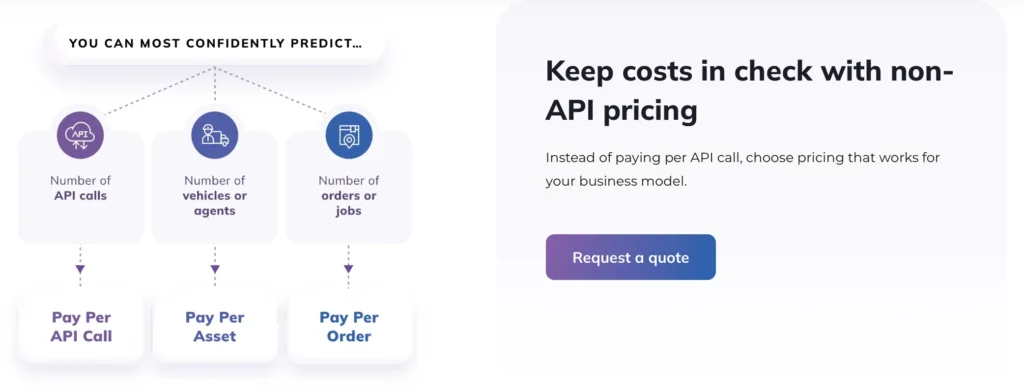

In 2025, GPS mileage tracking solutions for delivery drivers have evolved to offer significant automation, compliance, and fleet administration capabilities, but not all products offer the same level of scalability, flexibility, or affordability. Whereas other platforms provide basic routing and mileage tracking, NextBillion.ai stands out with its powerful real-time, traffic-responsive optimization engine, ability to handle over 50 operational constraints, and flexibility to support a wide variety of business-specific use cases.

NextBillion.ai provides industry tailored customization, advanced vehicle and route optimization (including truck enablement and repeat deliveries), improved scalability to support huge fleets, and highly predictable usage-based pricing models. Its modern, API-first architecture enables simple integration with telematics and enterprise platforms, providing real-time flexibility and operation management unavailable on other platforms. NextBillion.ai is the top choice for businesses seeking future-proof, enterprise-grade mileage tracking and delivery optimization with real-time assistance, dynamic rerouting, and transparent pricing.

Contact us today and <book a demo> to learn more about how NextBillion.ai APIs can provide solutions for your GPS mileage tracking solutions for delivery drivers.

Prabhavathi is a technical writer based in India. She has diverse experience in documentation, spanning more than 10 years with the ability to transform complex concepts into clear, concise, and user-friendly documentation.